Another blog about AI? Yes, but not to worry: this time it's just concrete and applicable information. Written based on real experiences with internal and customer-focused AI solutions. This blog will help you choose an AI approach and make potential investments that suit your organization.

We'll start by showing how AI is already delivering returns in financial services. We'll discuss two key technologies: retrieval-augmented generation (RAG) and model context protocol (MCP). We'll also share current figures, including both European and Dutch examples, and conclude with a step-by-step plan.

Banks and insurers are feeling the pressure: customers expect real-time service, regulators are raising the bar, and new players are entering the market with digital solutions. Many executives and managers know that AI can be valuable, but struggle with the question: how do I apply AI in practice without getting lost in the hype and security risks?

AI Development and Application in Financial Services

AI is no longer an experiment. While early applications mainly revolved around simple chatbots, we now see AI having a profound impact on risk management, compliance, and customer service. McKinsey estimates the annual value of AI in banking and insurance at $200 to $340 billion.

Roger Hendriks, CTO at Fenêtre, explains:

“Within our company, everyone now works with AI at least once a day, from office managers to developers. We believe in AI and don't see it as the next hype. Our impact and quality are steadily increasing with the same staff.”

This is about achieving more, with the same people, rather than continuing to do the same with fewer people. It should be noted that the market for an IT company like Fenêtre is relatively scalable, which isn't true for every organization. In sectors where growth is limited, the real strength lies in working smarter and more effecient.

Standard packages vs. customized solutions

Do you choose a standard solution or a customized one? Eric Kruis, CEO at Fenêtre, puts it this way:

“Just like with custom applications, the more focused the solution, the greater the added value compared to your competitors. If you opt for a standard solution, there's definitely added value; if you go for a custom solution, the added value can be enormous. We see that SMEs sometimes dread the effort and investment in custom solutions.”

The 2 AI options for companies

If you want to use AI software, according to Roger Hendriks, there are roughly two options: "There are standard solutions like Microsoft Copilot for Business and ChatGPT, or a 'custom' chat module in the cloud."

1. Standard solutions like Microsoft Copilot for Business and ChatGPT.

These solutions are readily available and offer integration with Microsoft 365 and other commonly used business applications. However, there are disadvantages for European companies: these services fall under US jurisdiction, with the possibility of access by the US government. OpenAI now offers data residency for EU companies, but this does not (yet) apply to the widely used Teams version.

In addition, security issues have already been reported with both solutions. Extensive fine-tuning for company-specific requirements is also lacking. This can make Dutch companies hesitant to adopt these solutions. Regarding costs: in August, the ChatGPT Teams rate was €29 per user per month. For a company with 200 employees, this means a monthly expense of €5,800.

2. A "custom" AI chat module, open-source in the cloud

An open-source or custom chat module offers greater flexibility, better aligns with specific business processes, and can be less expensive in the long run. Such a custom module is linked to a cloud-based Large Language Model (LLM) and a local MCP server (see explanation below).

The benefits are clear: significantly more control, answers supported by your own company data, and full GDPR compliance without the risk of US access, provided you choose a European cloud provider.

Eric clarifies:

“The initial investment is higher, think €30-40k for a chat module with several MCP servers, but the savings on subscription costs are substantial. A calculation example: For 200 people with an average of 10 chats per day, each with 5 questions, this could roughly amount to €250 per month with a good open-source model. External hosting of the chat module costs approximately €3k per year. So, roughly speaking, we arrive at €46k for the first year. That quickly pays for itself for 200 employees. And with technologies like RAG and MCP, you can access your own data securely and flexibly, with more accurate answers.”

From information to action: RAG and MCP explained

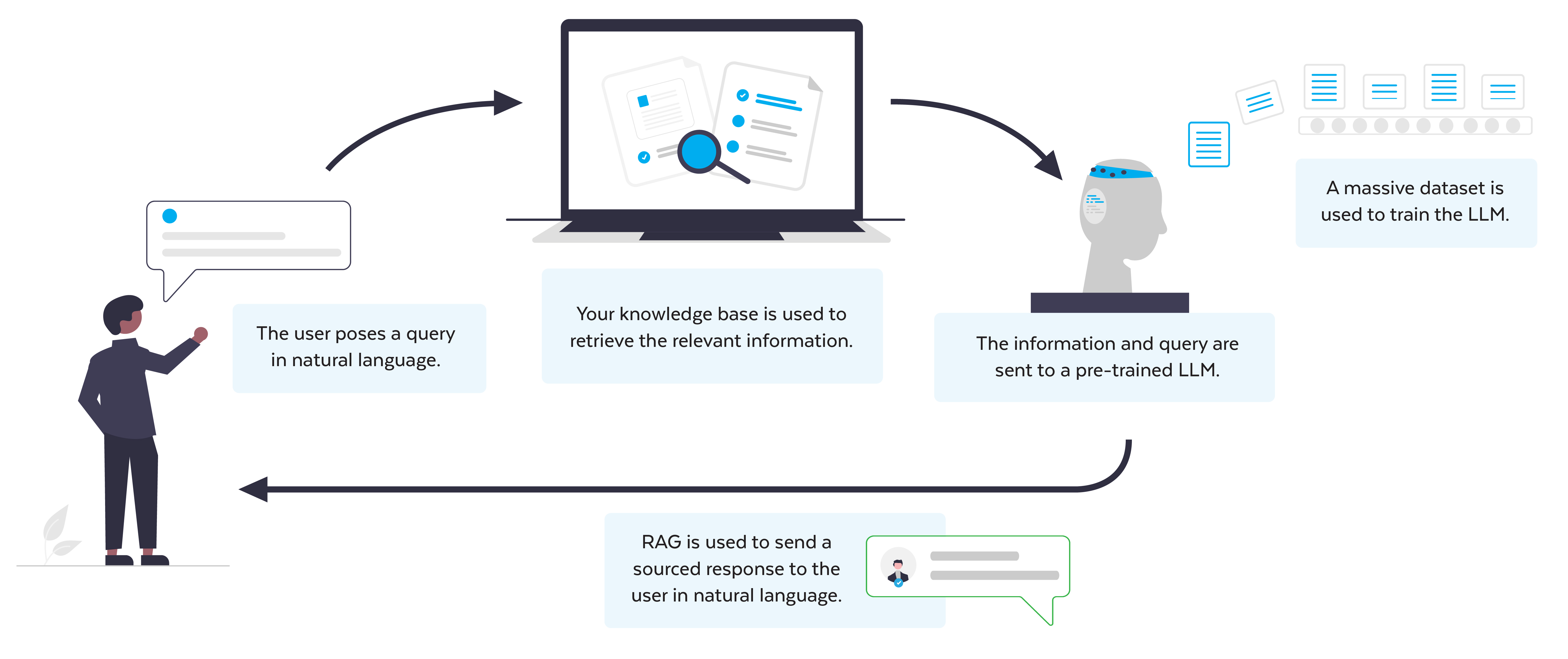

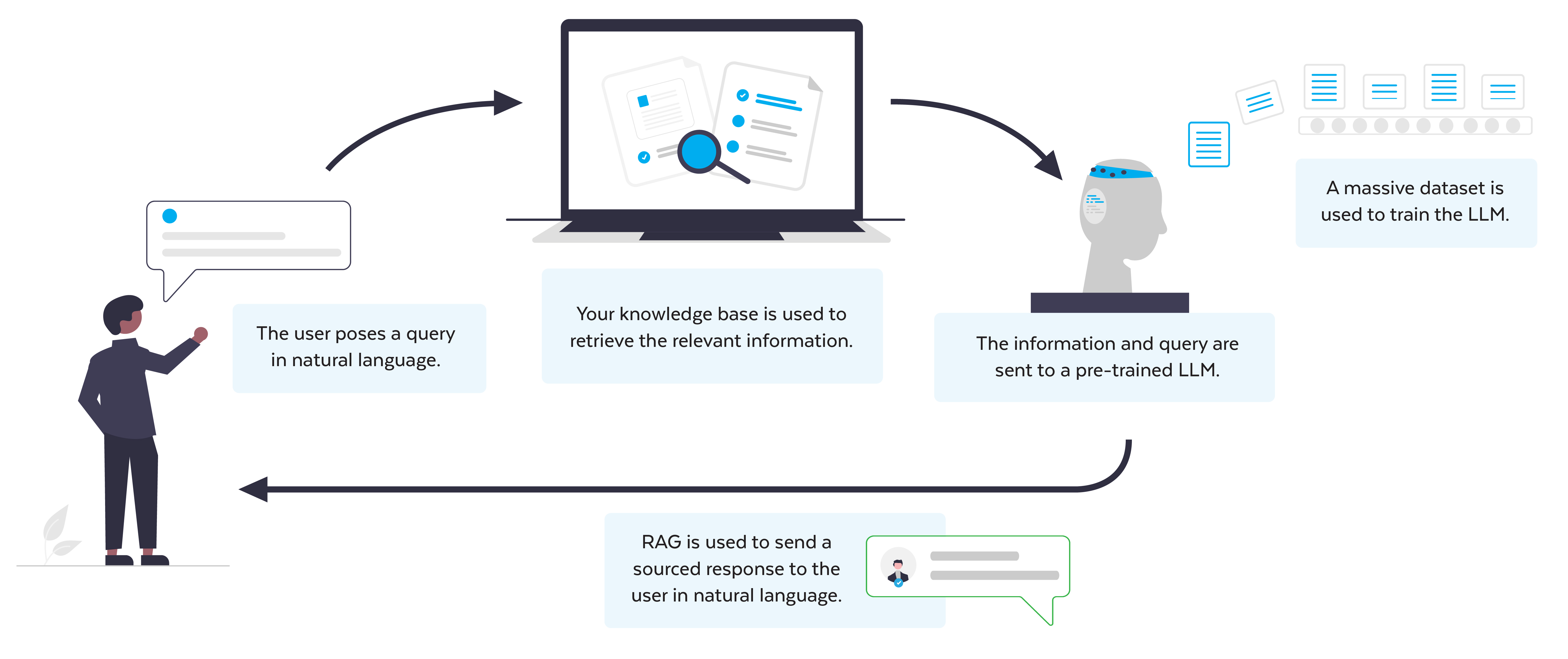

What is RAG?

Retrieval-Augmented Generation (RAG) links a language model to a data source. A customer asks if their insurance covers natural disasters. Instead of a generic answer, RAG first retrieves the correct policy document and bases the answer on that. This makes AI transparent and verifiable.

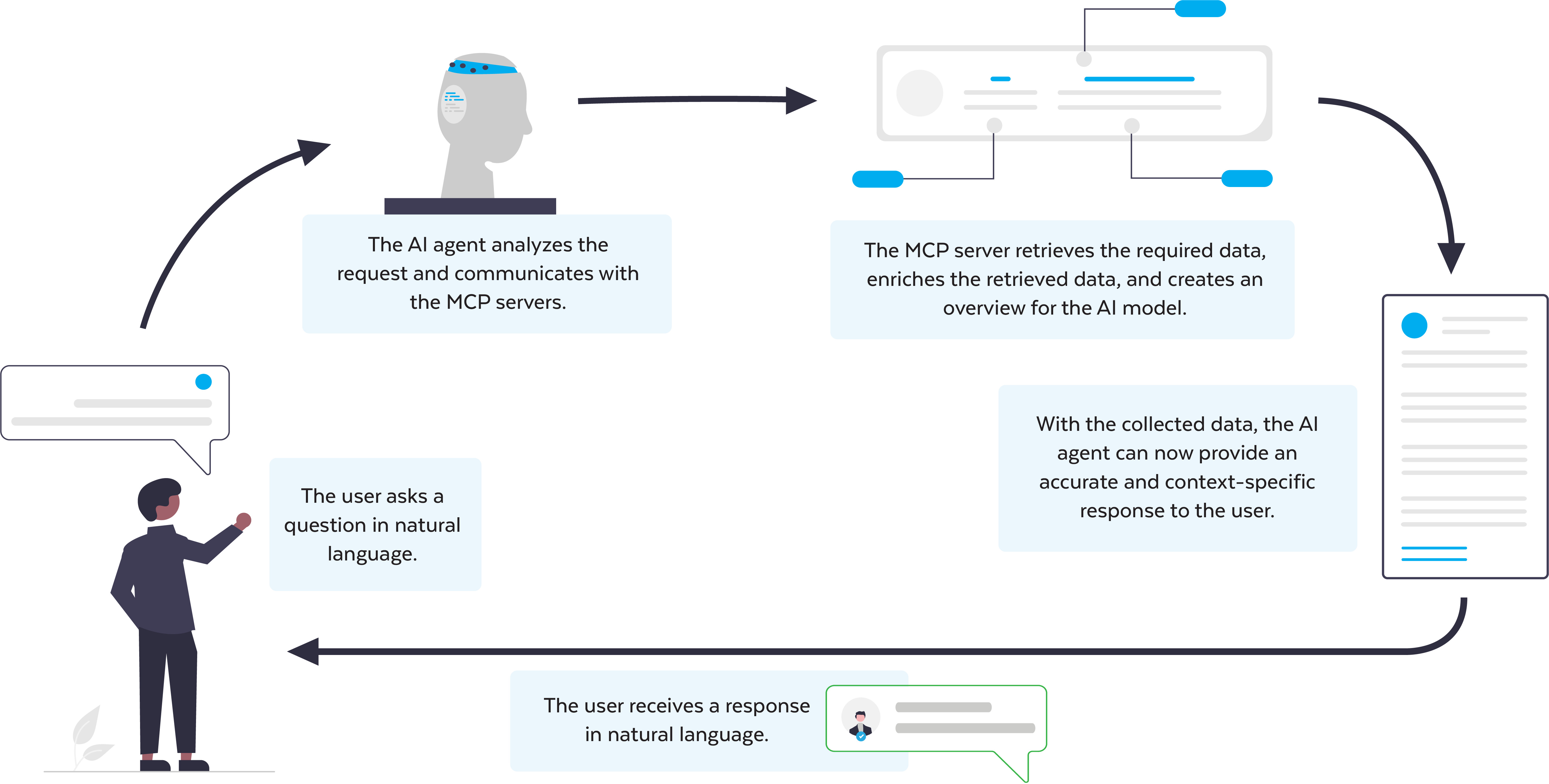

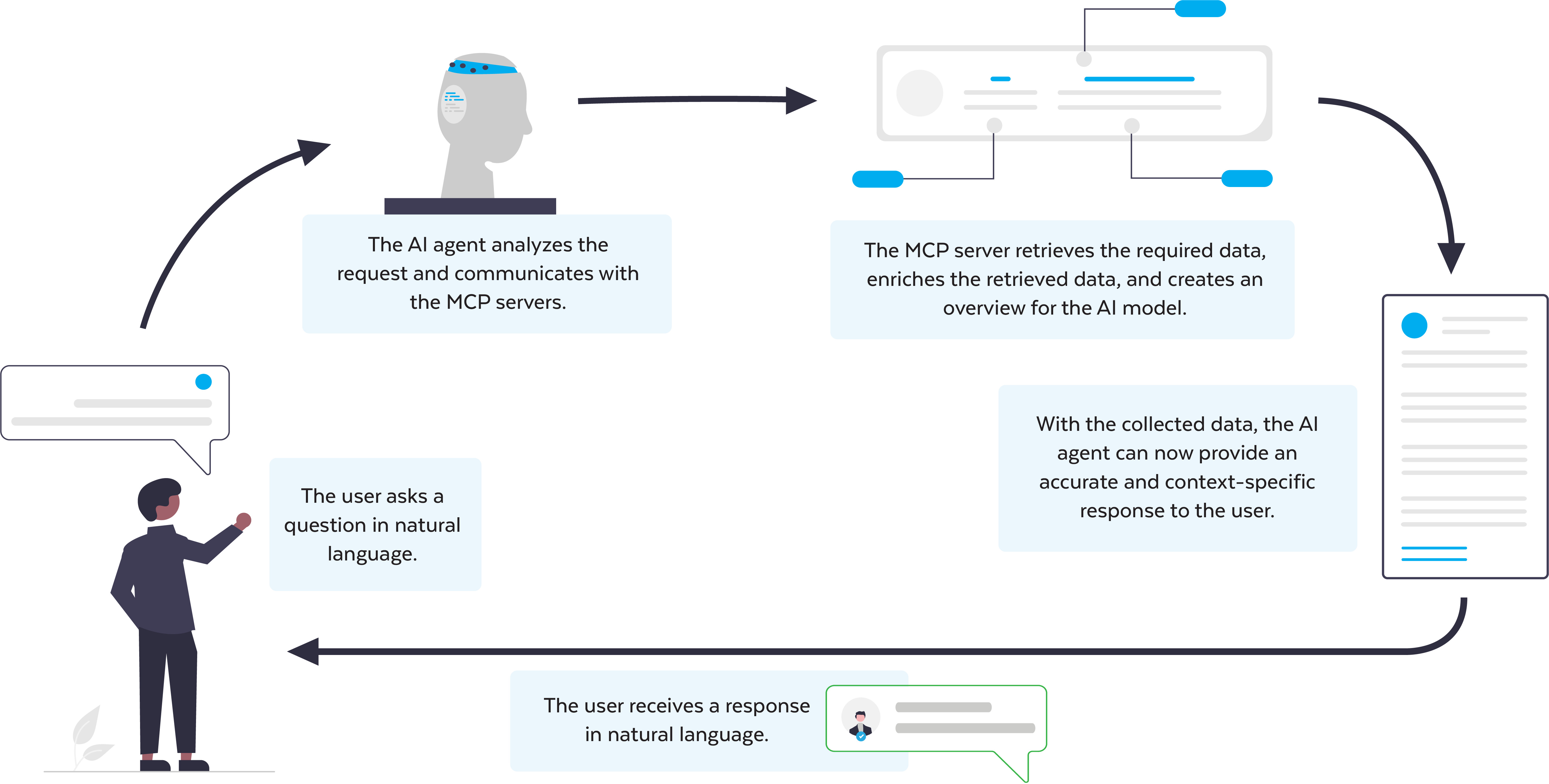

What is MCP?

The Model Context Protocol (MCP) is an open-source standard for securely linking structured data, such as database records, wikis, and API information, to Large Language Models. This way, your chatbot combines LLM language knowledge with your own information and delivers well-founded answers.

With both applications, you determine exactly which data will be shared, which ensures higher security and more applicable answers, using only the data you want to share.

The European and Dutch Context

Half of non-life insurers and a quarter of life insurers already use AI. But generative AI can deliver even more added value in the European financial sector. A presentation by the ABI (UK) shows that generative AI and LLMs are increasingly being integrated into customer and claims processes within the sector.

In the Netherlands, we see banks and insurers experimenting extensively. Concerns about privacy and explainability often hinder scaling up. Techniques like RAG and MCP offer a solution here: they make AI transparent, traceable, and more secure.

What are the concrete applications of AI in financial services?

The insurance world contains a wealth of data, data that can be used for all kinds of purposes to accelerate processing times, increase quality, and tighten compliance through the use of AI. Examples of processes where AI can deliver immediate value:

- Claim checks and predictions.

- Detecting fraud signals.

- Generating policies and change proposals based on products and history.

- Proposals for Premium calculation.

- Searching for and applying complex clauses.

How do you proceed? A step-by-step plan based on your current situation.

What is the right AI approach? What's next? Hendriks and Kruis outline several scenarios and possible steps:

1. You're currently using AI ad hoc

“A simple step is to give every employee a paid, managed license for Microsoft 365 Copilot or ChatGPT Teams to standardize and prevent data loss with the free versions. Set up an implementation process with leading roles, clear do's and don'ts, and short training sessions.”

2. You're currently using AI in a structured way with standard products

“Have you already taken a step further and want more compliance and answers that better suit your organization at a lower TCO? Consider a custom chat linked to an MCP server. If you prefer to stick with the standard solutions, you can investigate how the agent capabilities work and how to connect to additional data sources.”

3. You're already working on specialized access to your own data

“Take your AI environment to the next level with second-hand expertise or targeted advice on, for example, the architecture used, RAG options, and security aspects."

"For all steps," Kruis concludes, "a clear implementation plan with associated champions and targeted training are the prerequisites for sustainable success. And above all: guarantee privacy, security, and verifiability from day one."

Want personalized AI advice? Discover how your organization can work smarter, without getting lost in complex AI projects.

Get in touch now